Spotloan

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

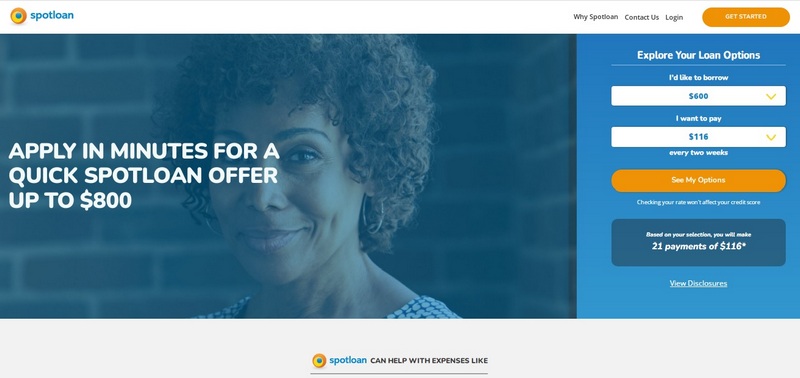

Request a LoanSpotloan is an online service that claims to be an “excellent payday loan alternative”. They offer small-dollar, short-term, high-interest installment loans. Unlike most payday lenders, Spotloan allows their clients to repay their loans in several payments. The company still charges high rates that are similar to payday loans. Spotloan is not licensed because they claim to be a subsidiary of BlueChip Financial, a tribally-owned direct lender founded in 2012 and based in Belcourt, ND.

| Company name | Spotloan |

| Founded | 2012 |

| Address | PO Box 720, Belcourt, ND 58316 |

| Website | spotloan.com |

| Phone number |

(888) 681-6811

|

| [email protected] |

Pros

- Fully online experience

- Easy application

- Fast funding

- Can repay loan over months

- Small loan amounts

- No prepayment penalties

- Bad credit is ok

- No origination fee

- Several payment options

- Prequalification does not affect your credit scores

- Educational resources

Cons

- Not available in all states

- Excessively high interest rates

- Large loan amounts not available

- Poor customer service and communication practices

- Ignores federal and state protections for consumers due to tribal ownership

Bottom line

If you find yourself in a difficul situation that requires emergency expenses, a small-dollar installment loan from Spotloan could be a nice option rather than using a traditional payday loan which would have a shorter payment schedule. This company is also suitable if you have poor credit or zero credit. If you have good credit or want a larger loan amount, we suppose you can find a cheaper loan before you borrow from this lender.

Types of loans

The lender offers unique short-term installment loans that differ from traditional payday loans that are repaid in one lump sum on the day you get paid. They offer installment loans lasting from 3 to 10 months. Payment schedules usually require bi-weekly payments. Loans can be anything up between $300 and $800. The maximum APR is 490%.

Eligibility criteria

Here are the Spotloan borrower requirements:

- Be a US citizen or permanent US resident;

- Have a stable income;

- Have a valid personal bank account;

- Have a phone number and email address;

- Be 18 years old or above;

- Provide proof of identity (SSN).

Category: Online Loans

Tags: Alabama, Alaska, Arizona, California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Texas, Utah, Washington, Wisconsin, Wyoming

Posted by MiaAshton