LendUp

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

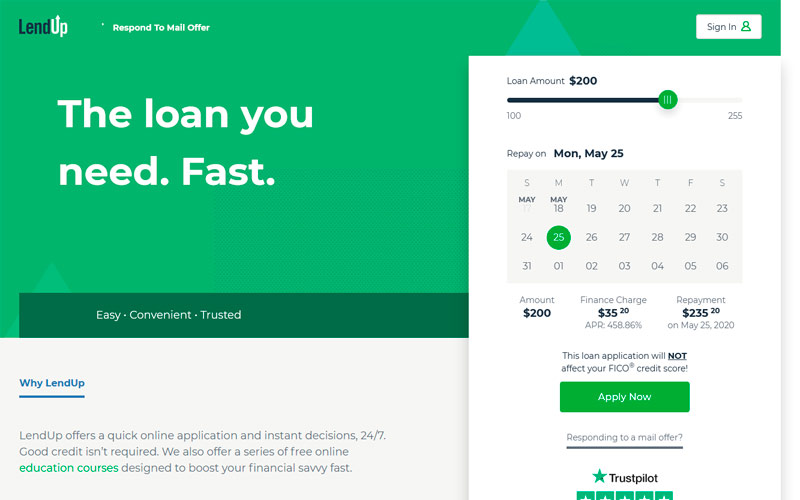

Request a LoanLendUp is an online direct lender that offers personal loans ranging from $100 to $1,000 with APR 41.89% to 1251.43%, credit card services and financial education for consumers. The company appealing to customers because they approve loan applications even if you have a bad credit history.

| Company name | LendUp Loans, LLC. |

| Founded | 2012 |

| Address | 1750 Broadway, Suite 300 Oakland, CA 94612 |

| Website | lendup.com |

| Phone number | (855) 253-6387 |

| [email protected] |

Pros

- Direct lender

- Credit card provider

- Multiple payment options

- Apply in as few as 5 minutes

- Various loan services

- Instant decision

- Good credit not required

- An incentive program to get larger loans at lower APRs

- Potentially fast funding

Cons

- Loans carry high APRs

- State loan restrictions apply

- Need an active checking account

- Available in a limited number of states

Bottom line

LendUp offers loans, credit card services, and educational tools that help you manage your finances in a smart way. If you have a poor credit score, live in a state where the lender operates, and are searching for fast and legit credit card services or a small personal loan, this company’s website may help you solve your temporary financial need.

Types of loans

LendUp provides loan services, credit cards and financial education. Their main services include:

- Payday loans

- Short-term loans

- No-credit-check loans

- Cash advances

- Online loans

- Payday advances

- Bad-credit loans

LendUp loan requirements

LendUp does not disclose eligibility requirements, such as minimum income or minimum credit score. Their eligibility requirements vary by state. However, they mention that they review applications with bad credit or no credit — but they still consider several factors, including your source of income and debt-to-income ratio.

In general, they will need your name, address, Social Security number and bank checking account routing number for direct deposit. In several states, you’ll also have to provide them with a copy of your latest pay stub to verify your stable income.

Category: Online Loans

Tags: Alabama, California, Florida, Hawaii, Idaho, Illinois, Indiana, Kansas, Louisiana, Maine, Minnesota, Mississippi, Missouri, New Mexico, Ohio, Oklahoma, Oregon, South Carolina, Tennessee, Texas, Utah, Washington, Wisconsin, Wyoming

Posted by Marina Clay