Installment Loans

Installment loans can become a real life-saver in tough times. They are often better than credit cards, payday loans and lines of credit. In this article, we’ll explain the installment loans definition, their different types, and a bit about how they work.

Contents:

- What are installment loans and how do they work?

- What can I use an installment loan for?

- Installment loan requirements

- How do I apply for an installment loan?

- Installment loan costs/fees

- Installment loans in your state

- Types of installment loans

- Tribal installment loans: 5 things to know

- Can I get an installment loan if I have bad credit?

- Bad-credit installment loans vs. payday loans

- How an installment loan affects your credit

- How to find the best installment loans

- What to consider when getting an installment loan online

- Benefits and drawbacks of installment loans

- Reasons why you’re denied an installment loan

- Frequently asked questions about installment loans

- Alternatives to bad credit installment loans

What are installment loans and how do they work?

Installment loans differ from credit cards or lines of credit, which typically have more flexible repayment terms and variable interest rates — meaning you don’t have a predetermined monthly payment. With easy installment loans near me, you always know what to expect every month.

What can I use an installment loan for?

One of the benefits of an installment loan is that it can be used for a veriety of purposes. You can borrow funds to pay for a major purchase, such as a vehicle or a home. A personal loan, one of the most popular types of installment loan, can be used to pay for:

- A car;

- A home;

- Debt consolidation;

- A special family event;

- Home improvement;

- Emergency expenses.

Installment loan requirements

Anyone can apply for a loan. The process is fast and easy. All you need is to meet a few requirements and provide some personal and income information:

Personal Information:

- Name;

- Home address;

- Email address;

- Phone number;

- SSN or Individual Taxpayer Identification Number.

Income Information:

- Proof of a steady source of income (wages, disability benefits, pension, or another income source);

- Proof of active bank account that has been open for at least one month.

How do I apply for an installment loan?

-

Compare offers. Lenders use various methods for assessing your solvency and processing loan applications, so we recommned that you compare personal installment loans from different companies. Also consider other forms of financing, like credit cards or lines of credit, especially when you need a lot of money.

- Pre-qualify. Getting pre-qualified for a loan lets you see available loan amounts, rates and payments without damaging your credit history. You can then find out how the payments fit into your budget.

- Boost your application. Before you apply, consider a secured loan with collateral. This option may help you get approved for a lower rate or higher loan amount. Just know there are consequences if you default on your loan: you may lose your collateral.

- Apply. Monthly installment loans are offered by banks, credit unions and online lenders. The processing times vary by loan type and company.

Installment loan costs/fees

Installment loan fees and amounts will vary by state and lender. Usually, you can compare rates and terms in your state with simple installment loan online calculators.

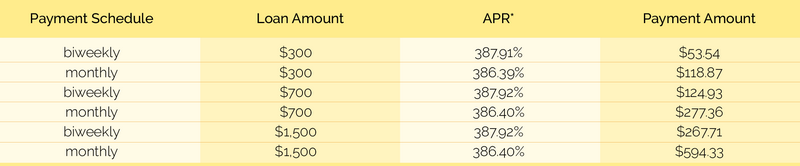

Below are some examples. The first table shows the Annual Percentage Rate (APR) and Finance Charge for the Utah installment loan with autopay for a 182-day term:

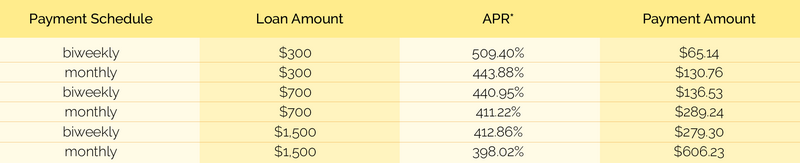

The second table shows the Annual Percentage Rate (APR) and Finance Charge for the Utah installment loan with autopay for a 184-day term:

Installment loans in your state

Installment loans are available in the following states:

- Alabama. Installment Loans range from $2,100 – $5,000 and are paid in regular payments over eight months in either weekly, bi-weekly, or monthly payments.

- Alaska. Loan amounts range from $1,000 to $40,000 and loan term lengths are 36 months or 60 months.

- Arizona. Installment loans in Arizona range between $1,000 and $5,000, and terms range from 7 to 26 months.

- Arkansas. In Arkansas, you can get up to $5,000 for up to 12 months.

- California. In California, it is allowed to apply for an installment loan between $1000 and $5000 and repay it in 6 to 36 months.

- Colorado. In Colorado, installment loans are available at any of our Colorado stores ranging from $100 to $1000 for up to sixty days.

- Delaware. An installment loan in Delaware can range in size from $200.00 to $2,400.00 and is repaid in multiple installments up to one year.

- District of Columbia. Residents of District of Columbia can apply for $1,000 – $5,000 unsecured installment loans for up to 60 months.

- Florida. Bad credit installment loans online for bad credit are given for the period of 60-90 days. The maximum loan amount is $1,000.

- Georgia. Loans can range from $500 for a start and, sometimes, extend to $10,000. Terms usually do not exceed 36 months.

- Hawaii. You can borrow between $500 to $5,000 and repay the loan over 7 to 26 months.

- Idaho. Idaho installment loans fall between $100 and $3,000. The repayment term ranges from 4 to 26 months.

- Illinois. You can borrow between $1,000 and $5,000 for up to 36 months.

- Indiana. In Indiana, you may be able to qualify for an online loan between $500 to $5,000 for up to 36 months.

- Iowa. In Iowa, you are allowed to take out an installment loan as high $5000 for 1 – 30 months.

- Kansas. In Kansas, it is allowed to apply for same-day installment loan between $1000 and $5000 and repay it in 6 to 36 months.

- Kentucky. Loan amounts range from $200 – $1,500. The maximum period for an installment loan in Kentucky is 180 days.

- Louisiana. In Louisiana, it is allowed to apply for an installment loan between $1000 and $5000 and repay it in 6 to 36 months.

- Maine. Direct lender installment loans in Maine are provided in the amounts of $1,000 to $5,000 for the term of 3-36 months.

- Michigan. In Michigan, it is allowed to apply for an installment loan between $1000 and $5000 for 4 – 24 months

- Minnesota. In Minnesota, you can get $1,000-$5,000 for up to 36 months.

- Mississippi. An installment loan in Mississippi can range in size from $200.00 to $2,000.00 and is repaid in multiple installments up to one year.

- Missouri. In Missouri, lenders offer installment loans from $100 – $2,000. Your loan payments typically start on your next pay date and run for approximately 12 months.

- Montana. Loan amounts range from $500 to $5,000. Terms go from 7 months to 26 months.

- Nebraska. No credit installment loans in Nebraska range from $500 for a start and, sometimes, extend to $10,000. Terms: 6 to 36 months

- Nevada. Nevada installment loans range from $50-$5,000 and are repaid within 1-3 months.

- New Hampshire. You can borrow $1,000 to $5,000 for the term of 3-36 months.

- New Mexico. In New Mexico, you can apply for an installment loan from $100 to $2,000. Loan term: 12 – 24 months

- North Carolina. You can usually borrow $1,000 to $5,000. Loans can be paid off in as little as a few weeks and as long as 30 months.

- North Dakota. In North Dakota, your pre-approved installment loan could fall within the following ranges: $1,250 to $5,000. You can repay the loan over eight to 23 months.

- Ohio. Ohio installment loans bad credit usually go up $5000. They are paid gradually in installments over 5 to 12 months.

- Oklahoma. In Oklahoma, installment loans range from $500 – $5,000, and the terms range from 7 to 26 months.

- Oregon. In Oregon, it is allowed to apply for long term installment loans between $1000 and $5000 and repay it in 6 to 36 months.

- Rhode Island. In Rhode Island, it is allowed to apply for an installment loan between $1000 and $5000 and repay it in 6 to 36 months.

- South Carolina. South Carolina installment loans are available in amounts from $750 up to $5,000. These loans are paid in regular payments over 6, 12, 18 or 24 months.

- South Dakota. In South Dakota, it is allowed to apply for an installment loan between $1000 and $5000 and repay it in 6 to 36 months.

- Tennessee. You can borrow up to $5,000 for up to 36 months.

- Texas. An installment loan in Texas can range in size from $200.00 to $1,200.00 and is repaid in multiple installments up to six months.

- Utah. An installment loan in Utah can range in size from $200.00 to $2,400.00 and is repaid in multiple installments up to one year.

- Virginia. Residents of Virginia can apply for an Installment Loan from $1,000 up to $5,000. Loan terms: up to 36 months.

- Washington. You can borrow $1,000 to $5,000. Loans can be paid off in as little as a few weeks and as long as 36 months.

- Wisconsin. Installment loans in Wisconsin are available to those who are qualified and need between $100 and $1,500. The loan term is approximately 12 months.

- Wyoming. You can apply for an installment loan from $100 to $5,000 for a period from 30 days to several months.

Types of installment loans

There are two categories of installment loans: secured and unsecured.

A secured loan requires collateral as security against the loan. The lender can become the owner of your collateral if you are unable to make payments; that means that if you can’t repay your mortgage, for instance, the lender can repossess your apartment. Personal loans are typically unsecured, which means personal loans usually require no collateral.

Here are the most common types of installment loans offered across the USA:

- Personal loans: Personal loans can be used for almost any reason such as debt consolidation, medical treatment, home improvement or a wedding. Available loan amounts range from $1,000 to $100,000, and repayment terms are typically 2 to 7 years. Personal loans are provided by traditional financial institutions like banks, credit unions and also online lenders that specialize in same-day transactions. The interest rate can vary depending on your credit score.

- Auto loans: These installment loans are used when buying a car. Since they’re secured with the vehicle as collateral, you are at risk of losing your car if you can’t repay you loan. But as a result, car loans typically comewith much lower interest rates than unsecured loans.

- Mortgages: Mortgages (home loans) are secured installment loans used to purchase a house. Mortgages are paid off with interest in monthly increments typically over 10 or 30 years. Similar to car loans, your home is used as collateral, which keeps mortgage interest rates lower than unsecured loan rates. But it also means you can lose your home if you can’t make payments.

- Student loans: These are installment loans that are used to finance higher education and they are provided by the federal government or a private lender. Interest rates and terms vary by lender depending on whether they’re federal or private.

Tribal installment loans: 5 things to know

Tribal installment loans are provided by financial institutions that offer financial services on sovereign lands, they are managed by Native American tribes. The best tribal installment loans are issued online. Most users prefer direct tribal lending as it is a fast and simple because there are no intermediaries.

- Tribal installment loans for bad credit are often for small amounts. Small installment loans typically do not exceed $1,000.

- Tribal loans are often short-term installment loans. Loan terms are typically less than 12 months.

- Some tribal lenders have claimed exemption from state and federal regulations. You don’t need to live in a tribal nation to apply for a tribal loan. They say they are wholly owned and operated by a tribal nation.

- You can usually apply online. You don’t need to live in a tribal nation to apply for a tribal loan.

- You may be charged a sky-high interest rate. Some tribal lenders in certain jurisdictions are currently charging an APR of nearly 800% APR.

Can I get an installment loan if I have bad credit?

Borrowers with poor or less-than-perfect credit profiles (below 630 FICO) may be able to get a bad credit installment loan. Some lenders have lower credit score requirements and consider other information, like your current income, recent bank account transactions, employment, education and existing debts. Credit unions and online lenders often accept bad-credit borrowers, while banks tend to require good or excellent credit. Bad credit installment loans guaranteed approval are the most popular products for 2022.

Bad-credit installment loans vs. payday loans

Installment loans are repaid in installments — this doesn’t usually apply to payday loans. It also makes them safer than payday loans because it is easier to make smaller payments over time than repaying a lump sum at once. The table shows the major differences between installment and payday loans.

| Installment personal loans | Payday loans |

| Repaid over several months to many years. | Repaid in full within 1-3 weeks — usually as soon as you receive your next paycheck. |

| APR of 36% or below. | APR can be as high as 400%. |

| Usually repaid online, over the phone or by check. | Lenders withdraw the money from your bank account, using either a check you wrote ahead of time or your account information. |

| Usually require a credit check to assess your ability to pay off the loan. | Do not require a credit check. |

| Report on-time payments to credit bureaus to help build your credit. | Do not report on-time payments to credit bureaus to help you build credit. |

How an installment loan affects your credit

Applying for instant funding installment loans often requires a credit check, which can temporarily lower your credit score a few points. Besides, such loans can improve your credit if you make timely payments.

Credible lenders report on-time payments to at least one of the three major credit bureaus, TransUnion, Equifax, and Experian. Payment history makes up 35% of your FICO score, and on-time installment loan payments help improve that history.

If you miss your payments or make payments late, the consequences can be severe. A payment that’s 30+ days late can reduce your credit score by 100 points. Most lenders have the option to withdraw the funds from your account automatically, which means you will never forget to pay.

How to find the best installment loans

Finding cheap installment loans with the best rates largely depends on factors such as your credit and finances. It’s also a matter of knowing what to look for when shopping. Here’s what you can do to find the best installment loans for bad credit with the most favorable rates:

-

Check your credit. Check your credit to make sure there aren’t any errors. Certain types of discrepancies, such as whether you were late on a payment, could lower your score.

- Maintain a good score. If your credit file is poor or you’re working on improving your credit, be sure to make payments on time, keep your debt-to-income ratio low and consider having a mix of credit.

- Research eligibility requirements: While your credit score is one of the most important factors in assessing your solvency, lenders may also look at other factors, such as your income and debt-to-income ratio. If your credit is poor or fair, look for lenders that pay little attention to credit scores and look at your income instead to determine your creditworthiness.

- Look at repayment terms: Most personal loan lenders set repayment terms at 2 to 5 years, although some extend terms to 10 years. Choosing a shorter repayment term will increase your monthly payment but will decrease the interest you’ll pay overall. If you can’t get the lowest interest rates because of your credit score, choosing a shorter term could help you save money.

What to consider when getting an installment loan online

Financial experts warn that it is necessary to take a loan with all responsibility in order to avoid trouble in the future.

Below are the three important points that a potential borrower should pay attention to before taking an installment loan:

Set your goal

Answer honestly to the question: “Why are you going to take a loan?”. A loan in general is a very convenient financial instrument, but you need to know how to use it correctly.

Banks issue loans for the purchase of housing, cars, for large purchases. Loans are divided into non-targeted – when the bank issues a certain amount for various needs of the borrower, and targeted – with a clearly defined purpose: for the purchase of housing, for education and more. Loans differ in the maximum loan amount, interest rate, terms and collateral. Banks can issue them both independently and together with partners – car dealers, construction companies, household appliances stores and other organizations. Therefore, decide which type of loan suits you best.

Assess your ability to pay

The second step should be to assess your own financial condition and solvency. Answer the second question for yourself: “Will you be able to make payments if you suddenly get sick or lose your job?”. Count on a permanent source of income. You can’t rely on the lottery or the promised bonus at work.

It is very important that the monthly payment on your loan obligations does not exceed 50% of your income. Only in this case you will be more or less confident in the future and timely payment. By the way, if you have made an informed decision about obtaining tribal installment loans guaranteed approval, then you must definitely check your credit history before applying. There were cases when borrowers became victims of financial scammers, and other people’s loans were issued to them. Therefore, credit history should be checked periodically.

Learn what banks offer

It is recommneded to study the market of bank loans, to monitor the websites of online lenders. Find out the loan terms, the available loan amounts, monthly payments, repayment options, the interest rate, possible penalties, early repayment option, other fees, etc.

The law provides for the obligation of lenders to disclose full information regarding the terms of the loan. So, before you sign a loan agreement, the lender is obliged to provide the comprehensive information about the loan.

Pay attention to the convenience of the location of ATMs and terminals for future loan servicing – it is also an important criterion. Always carefully read the agreement before you sign it. Do not take a loan unnecessarily. Not all borrowers manage to close their debts on time. Make sure you can afford payments.

Benefits and drawbacks of installment loans

Installment loans have many advantages. A few include:

✔Make it possible to pay off big purchases over time.

✔Have predetermined monthly payments.

✔Cover a wide range of needs with multiple types of loans.

✔Can be repaid early, usually with no penalty.

Cons of installment loans:

❌Only allow one-time borrowing, while revolving credit allows borrowing on demand.

❌May require collateral.

❌May charge fees, such as origination fees or mortgage closing costs.

❌Cost more in interest the longer they last.

Reasons why you’re denied an installment loan

Common reasons for loan rejection are:

- Bad credit history. Not all leders work with bad credit. But you can improve your credit history by carefully servicing existing loans. The main thing is to stick to the schedule. Some borrowers open a credit card specifically for this purpose in order to use the grace period.

-

False information provided by the borrower. This is another common reason for loan rejection. Any mistake in the application form can cause a loan rejection, so you should be careful when filling out an application form.

- Excessive debt load. If the lender doubts that the borrower’s income is sufficient to service the loan, your request may get declined. Today, banks calculate the borrower’s debt burden indicator. If the total monthly payments on all obligations, including a new loan, exceed 50% of income, the risk of default increases greatly. And the bank refuse a loan.

- Suspicious behavior of the borrower. The bank may reject your request due to your strange behavior, for example, excessive nervousness, alcohol intoxication, poor speach, and other factors. In addition, scammers often try to take loans: they use fake people or fake documents. If a bank suspects fraud, they usually refuse to lend.

- Informal employment. A person who works unofficially cannot reliably confirm his income, so the bank is deprived of the opportunity to correctly assess his solvency. This makes the risk of default too high. Therefore, most organizations tend not to deal with borrowers who cannot provide proof of income.

- Recent failure. Banks study the applicant’s credit history, which, among other things, displays all his previous applications in other banks and microfinance institutions. If it turns out that the borrower was rejected previously, this is a reason to be wary. A large number of unsatisfied applications has a particularly bad effect on credit history. This may raise the suspicion that scammers are trying to act on your behalf. Therefore, by the way, it is not recommended to send several applications to different credit organizations at once.

- Non-compliance with lender requirements. For example, some banks do not issue loans to representatives of certain professions. Or they issue loans only to conusmers who are at least 21, and you are only 20.

Frequently asked questions about installment loans

What happens if you don’t pay an installment?

Whenever you miss a payment, you can be charged a late fee. When your next bill is due, you’ll have to make two months of payments + the late fee. Because of that catching up can be difficult and it’s more difficult the higher your monthly payments are.

What happens if I default on an installment loan?

When a loan defaults, it is sent to a debt collection agency whose job is to contact the borrower and receive the unpaid funds. Defaulting will drastically reduce your credit score, impact your ability to assess future credit, and can lead to the seizure of personal property.

Can you pay off an installment loan early?

In most cases, repaying a loan early can save money, but check first to make sure prepayment penalties, precomputed interest or tax issues don’t neutralize this advantage.

Can you have multiple installment loans?

You can have more than one personal loan with some lenders or you can have multiple personal loans from different lenders. You’re generally more likely to be blocked from getting multiple loans by the lender than the law. Lenders may limit the number of loans — or total amount of money — they’ll give you.

Alternatives to bad credit installment loans

Online installment loans are not the only way to get cash needed for various purposes. Here are some other options.

- Personal lines of credit. A personal line of credit is a set amount of money from which you can borrow (up to the limit) for a given period of time, referred to as your draw period. Similar to a credit card, you draw from the available balance only the amount you need, and you pay interest on that amount. A personal line of credit is unsecured, meaning you don’t need to put up collateral like your car or house.

- Credit-builder loans. A credit-builder loan (also known as a fresh-start loan or starting-over loan) holds the amount borrowed in a bank account while you make payments, building credit. As an added bonus, you earn dividends as you pay off the loan.

- Payday alternative loans. These are small dollar, short term loans designed to help members of some federal credit unions when money is needed right away to meet unexpected expenses. Payday alternative loans typically have much lower fees and annual percentage rates than traditional payday loans.

Secure Service

Secure Service

Bad Credit Friendly

Bad Credit Friendly

Quick Application

Quick Application

24/7 Client's Service

24/7 Client's Service

Compare offers. Lenders use various methods for assessing your solvency and processing loan applications, so we recommned that you compare personal installment loans from different companies. Also consider other forms of financing, like credit cards or lines of credit, especially when you need a lot of money.

Compare offers. Lenders use various methods for assessing your solvency and processing loan applications, so we recommned that you compare personal installment loans from different companies. Also consider other forms of financing, like credit cards or lines of credit, especially when you need a lot of money.

Check your credit. Check your credit to make sure there aren’t any errors. Certain types of discrepancies, such as whether you were late on a payment, could lower your score.

Check your credit. Check your credit to make sure there aren’t any errors. Certain types of discrepancies, such as whether you were late on a payment, could lower your score. False information provided by the borrower. This is another common reason for loan rejection. Any mistake in the application form can cause a loan rejection, so you should be careful when filling out an application form.

False information provided by the borrower. This is another common reason for loan rejection. Any mistake in the application form can cause a loan rejection, so you should be careful when filling out an application form.