Figure

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

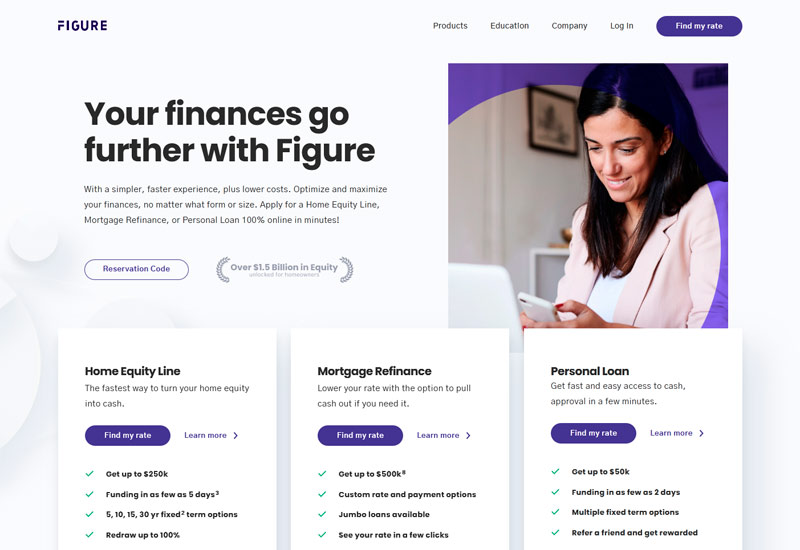

Request a LoanFigure is a lender that operates in almost all US states. It offers Home equity lie, mortgage loans, personal loans. All the procedure is conducted online and protected by secure connection.

| Company name | Figure Technologies, Inc |

| Founded | 2010 |

| Address | 50 California Street, Suite 2700, San Francisco, CA 94108 |

| Website | https://www.figure.com/ |

| Phone number | (888)-819-6388 |

| [email protected] |

Pros

- Online lender

- Free application

- Different products provided

Cons

- Increased APR

- Requires hazard insurance

Bottom Line

Figure is an online lender that offers home equity line, mortgage refinance, and pesonal loans. Home equity line offers to get up to $250k. Mortgage refinance approves up to $500k8. Personal loans approve up to $50k. The terms and rates are calculated individually.

Types of Loans

Figure offers:

- Home equity line;

- Mortgage refinance;

- Personal loans.

Requirements

- FICO credit score over 700;

- All applicants must be employed, self-employed or retired;

- The minimum required loan-to-value is 75% for cash-out refinances and 80% for rate refinances.

- The necessary debt-to-income requirements are 38% for a cash-out refinance and 43% for a rate refinance.

- Other terms and conditions may apply.

To qualify for a personal loan you have to meet the following requirements:

- Minimum of 680 FICO;

- Debt-to-Income (DTI) ratio

- Valid U.S. issued ID;

- Must be in good standing on any previous Figure loans;

- Figure does not lend to unemployed borrowers at this time;

- Retired applicants currently do not require VOE.

Category: Online Loans

Tags: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Posted by Deborah Wagner