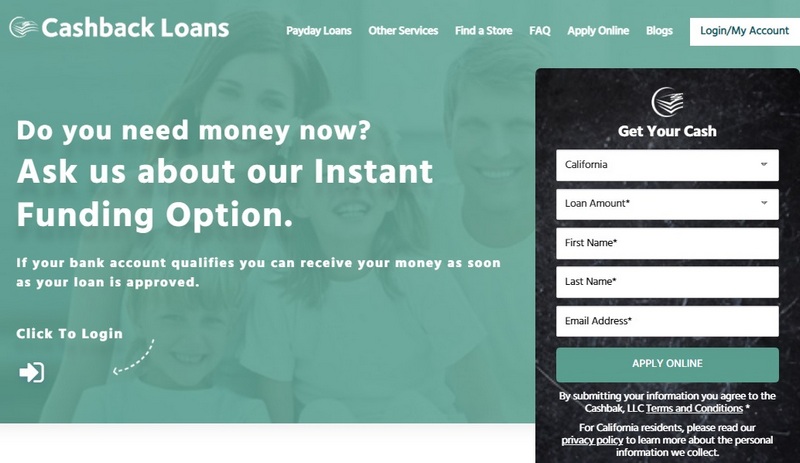

CashBack Loans

Online Payday Personal Consumer Loans up to $5,000

Easy Application, Fast Processing, Quick Approval, Any Credit Score

Request a LoanCashback Loans is a direct lender from California. It has been offering short-term loans to residents of this state since 2003. With three loan options, you can apply for a loan that suits your needs. The lender strives to provide a hassle-free loan service. Today the company has 29 locations across California. The lender is licensed by the Department of Corporations and operates under California law.

| Company name | CashBack Loans |

| Founded | 2003 |

| Address | PO Box 6090 La Quinta CA 92253 |

| Website | cashbackloans.com |

| Phone number |

1-888-668-8114

|

| [email protected] |

Pros

- Safe lender

- Fast online applicaion

- No credit check

- Bad credit is ok

- Quick turnaround

- Additional services: gift cars, MoneyGram, check cashing

- Payday fees clearly listed

- 29 stores across California

- Loan applications can be done on-site, online, or via call

Cons

- Only available in California

- High costs

- Risk losing your car

- Small amounts

- not BBB accredited

Bottom line

CashBack Loans is a California-based lender that offers payday loans, signature installment loans and title loans. Although the lender has a limited scope, it clearly states most of its fees and the costs of his loans. This lender is only suitable if you have short-term money difficulties. If you’re having long-term financial struggles, you’d better consider some short-term loan alternatives instead.

Types of loans

Cashback Loans offers three types of loans:

- Payday loans. You can borrow up to $300, though actually you’ll only receive $255 after the lender deducts a $45 loan fee – that’s $15 for every $100 borrowed. Terms vary, but most users repay their loans within 14 days.

- Signature loans. These are installment loans. You can typically borrow between $2,510 to $3,600. Terms last 24 to 36 months, and interest varies based on your credit score and income. There is also a $75 administration fee.

- Auto title loans. Auto title loans use your vehicle’s title as collateral. This means you can borrow between $2,510 and $50,000. However, you risk losing your car if you default on your loan.

You can apply for a loan online, by phone and at a store location. If accepted, you can choose to pick up your cash at a store or have them transfered to your bank account.

Eligibility criteria

Cashback Loans have easy to meet eligibility criteria. If you meet the following criteria, you may qualify for a payday loan or a signature loan.

- You are a resident of California

- You have a steady source of income

- You have a state-issued ID

- You are at least 18 years old

If you want to apply for an car title loan, you’ll also need:

- A driver’s license

- A lien-free title

- Proof of insurance